High Risk Homeowners Insurance - How can I avoid it?

Homeownership is a cornerstone of financial stability and personal comfort, but securing affordable homeowners insurance can be challenging, especially if your property is deemed high risk. High-risk homeowners insurance typically comes with higher premiums and limited coverage options. However, understanding the factors that contribute to a high-risk classification and taking proactive steps can help you avoid it. Here's a guide on how to minimize your risk and secure more favorable insurance terms.

Understanding High-Risk Homeowners Insurance

Insurance companies classify homes as high risk for various reasons, including the property's location, condition, and the homeowner's claims history. Here are some common factors that might lead to a high-risk designation:

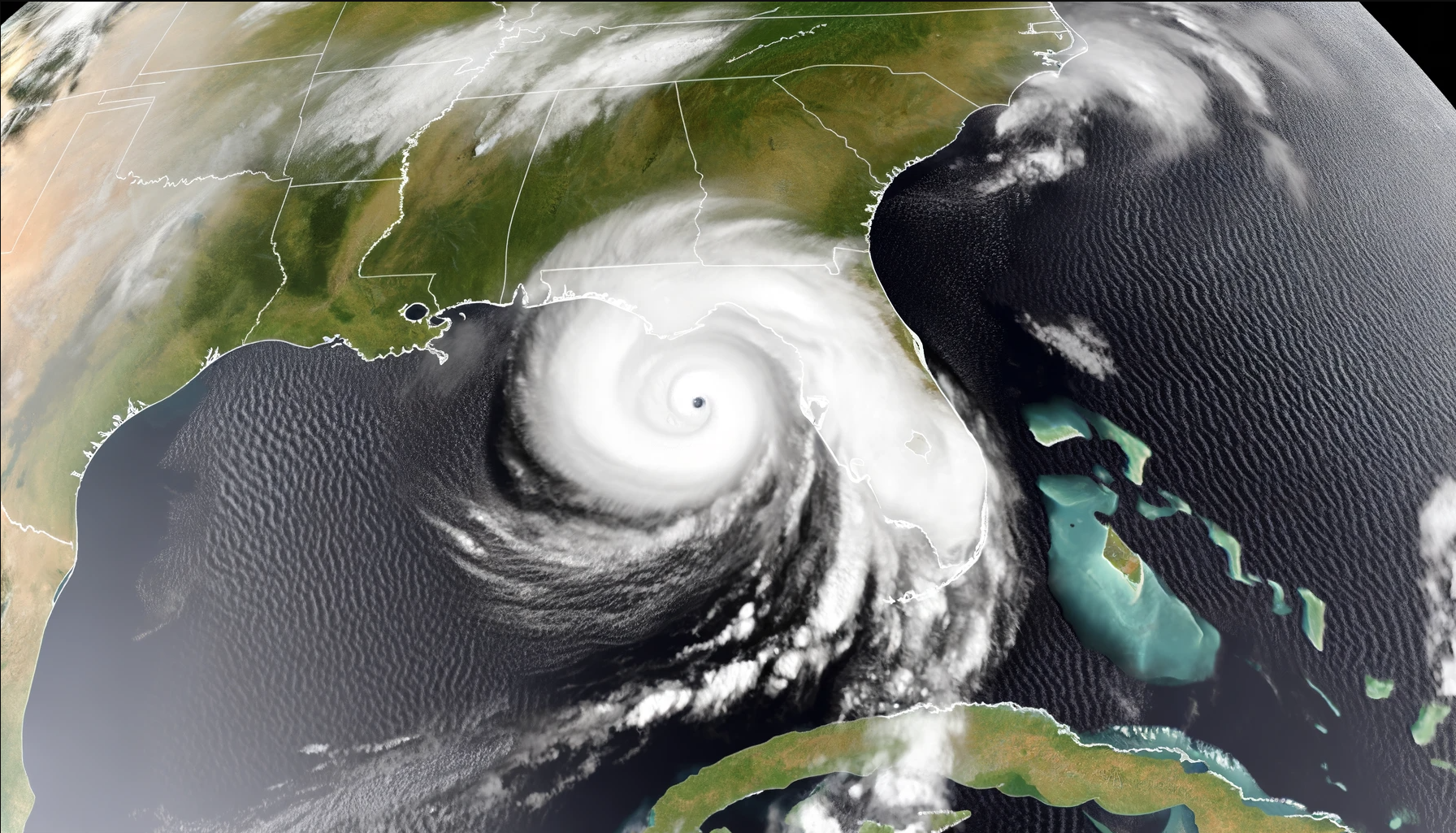

- Location: Homes in areas prone to natural disasters (e.g., hurricanes, floods, wildfires) are considered high risk.

- Home Condition: Older homes or those with structural issues, outdated electrical systems, or poor maintenance can be flagged.

- Claims History: A history of frequent insurance claims can raise red flags for insurers.

- Security Concerns: Properties in high-crime areas or those lacking security features may be deemed higher risk.

- Previous Cancellations: If you've had insurance policies canceled or not renewed, insurers might view you as a higher risk.

Steps to Avoid High-Risk Classification

1. Maintain Your Property

Regular maintenance and updates are crucial in demonstrating to insurers that your home is a safe bet. This includes:

- Roof Maintenance: Ensure your roof is in good condition and replace it if necessary.

- Electrical and Plumbing: Upgrade outdated systems to reduce the risk of fire and water damage.

- Structural Repairs: Address any foundation issues, cracks, or other structural concerns promptly.

2. Enhance Security

Investing in security features can significantly reduce your risk profile. Consider the following:

- Security Systems: Install a comprehensive security system with alarms, cameras, and monitoring services.

- Smoke Detectors: Ensure you have working smoke detectors and carbon monoxide alarms throughout your home.

- Reinforced Doors and Windows: Strengthen entry points to deter break-ins and reduce damage from severe weather.

3. Location Considerations

While you can't move your home, you can take steps to mitigate location-based risks:

- Flood Zones: If you live in a flood-prone area, elevate your home and install proper drainage systems.

- Fire Zones: Create defensible space around your home by clearing brush and using fire-resistant materials.

4. Manage Claims Wisely

Minimize the number of claims you file by:

- Increasing Your Deductible: Opt for a higher deductible to discourage filing minor claims.

- Handling Small Repairs: Pay out of pocket for minor repairs to avoid claims that could raise your risk profile.

5. Shop Around

Different insurers have varying criteria for high-risk classification. Obtain quotes from multiple providers to find one that offers better terms based on your specific situation. Look for insurers specializing in high-risk properties, as they may offer more competitive rates and coverage options.

Wrap-up

Avoiding high-risk homeowners insurance requires a proactive approach to home maintenance, security enhancements, and strategic management of your insurance policy. By understanding the factors that contribute to a high-risk designation and taking steps to mitigate them, you can secure more favorable insurance terms and protect your investment. Regularly review and update your insurance coverage to ensure it meets your needs while keeping costs manageable.

New Paragraph