Inflation and High-Risk Home Insurance

Inflation Makes Homeowners Insurance a Much Higher Risk to Insurance Companies

Inflation has long been a significant economic factor, influencing everything from the cost of groceries to mortgage rates. However, one area where its effects are particularly pronounced is in the realm of high-risk homeowners insurance. For those who own properties in disaster-prone areas or have histories of frequent claims, the rising cost of insuring their homes is becoming an increasingly pressing issue. This article explores how inflation impacts high-risk homeowners insurance and what homeowners can do to mitigate its effects.

Understanding High-Risk Homeowners Insurance

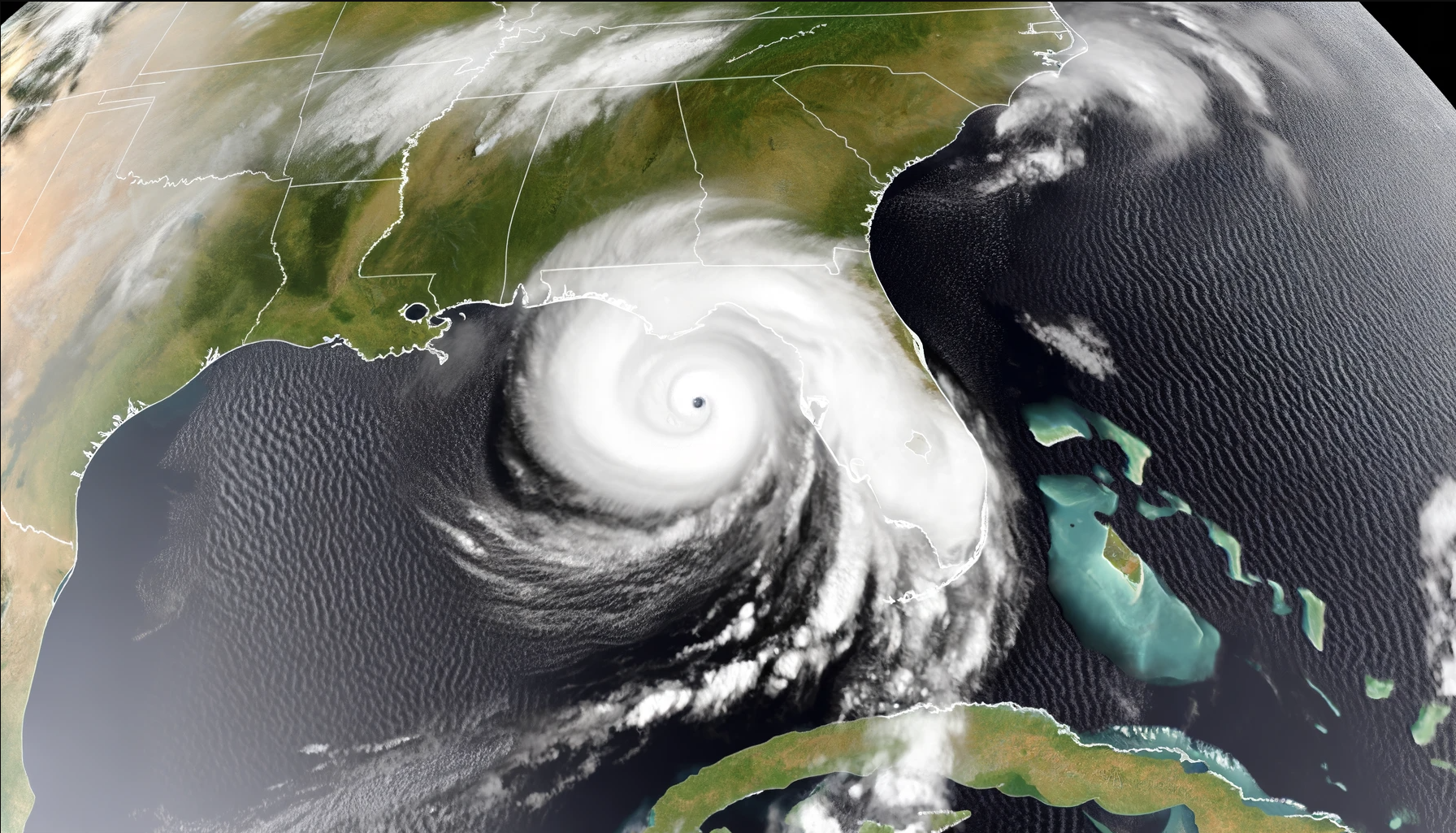

High-risk homeowners insurance caters to properties that are more likely to experience damage or loss due to various factors. These include homes located in regions prone to natural disasters like hurricanes, wildfires, or floods, as well as properties with a history of multiple claims. Given the higher likelihood of claims, premiums for these policies are already steep. Inflation exacerbates this burden, making coverage even more costly.

The Inflation Effect: Rising Premiums and Rebuilding Costs

Inflation directly influences the cost of goods and services, including construction materials, labor, and other resources needed for home repairs and rebuilding. When inflation rises, so do the costs of repairing or replacing damaged property. Insurance companies must account for these increased costs to remain solvent, leading to higher premiums for policyholders.

For high-risk properties, where the likelihood of claims is greater, the impact of inflation is even more significant. Insurers often adjust premiums annually to reflect these rising costs. According to industry experts, homeowners in high-risk areas have seen premium increases of 10% or more annually in recent years, outpacing the rate of general inflation.

Increased Claims Severity and Frequency

In addition to the rising cost of repairs, inflation contributes to the overall severity and frequency of claims. As construction costs soar, even minor damages can result in substantial claims. Moreover, high-risk homeowners are more likely to file claims due to the increased prevalence of extreme weather events, which have intensified due to climate change. This combination of inflation and a higher likelihood of claims creates a compounding effect, driving up insurance costs exponentially.

The Role of Reinsurance and Market Pressures

Reinsurance, or insurance for insurers, plays a critical role in the high-risk insurance market. Reinsurers provide financial backing to insurance companies, allowing them to manage risk and pay out claims. However, inflation affects reinsurers as well. As the cost of claims rises, reinsurers increase their rates, which are then passed on to the primary insurers and ultimately to policyholders.

Additionally, market pressures such as rising interest rates and economic uncertainty can lead to tighter underwriting standards. Insurers may become more selective in issuing policies or impose stricter conditions, such as higher deductibles or coverage limits, to offset their increased exposure.

Government and Regulatory Responses

Inflation’s impact on high-risk homeowners insurance has not gone unnoticed by policymakers and regulators. In some regions, governments have stepped in to provide relief through state-sponsored insurance programs or disaster relief funds. For example, in states like Florida and California, where natural disasters are common, government-backed insurance pools have been established to offer coverage to high-risk homeowners who might otherwise be unable to secure insurance.

However, these programs are not immune to inflation. They often face funding challenges, particularly during periods of economic downturn or when catastrophic events occur in quick succession. As a result, policyholders may still experience rising premiums, albeit at a potentially slower rate than in the private market.

Mitigating the Impact: Strategies for Homeowners

While inflation and rising insurance costs may seem inevitable, homeowners can take steps to mitigate their impact:

- Shop Around for Coverage: High-risk homeowners should compare quotes from multiple insurers to find the most competitive rates. Some companies may offer discounts or specialized coverage options that can lower overall costs.

- Invest in Risk Mitigation: Implementing measures such as storm shutters, fire-resistant roofing, or elevated foundations can reduce a property’s risk profile, potentially qualifying for lower premiums.

- Bundle Policies: Combining home insurance with other types of coverage, such as auto or life insurance, may result in discounts.

- Regularly Review and Update Policies: Homeowners should periodically review their coverage to ensure it aligns with current rebuilding costs and inflation. Underinsuring a property can lead to significant out-of-pocket expenses in the event of a claim.

- Consider Higher Deductibles: Opting for a higher deductible can lower monthly premiums. However, this strategy requires homeowners to have sufficient savings to cover the deductible in case of a claim.

What's the upshot?

Inflation presents a unique challenge for high-risk homeowners insurance, compounding the already significant financial burden faced by property owners in vulnerable areas. While premium increases are an unavoidable consequence of rising costs, proactive measures and informed decision-making can help homeowners navigate this challenging landscape. As economic conditions continue to evolve, staying vigilant and adaptable will be crucial for those seeking to protect their most valuable asset—their home.